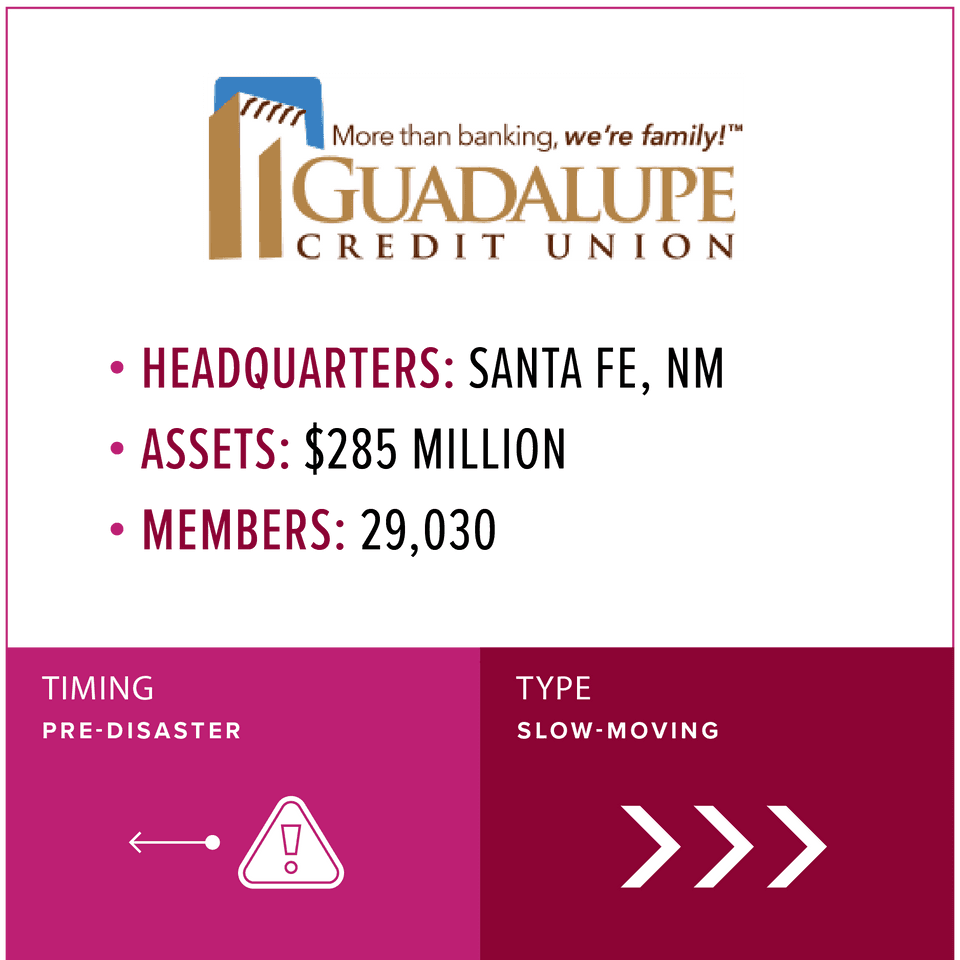

Overview

Guadalupe Credit Union has taken significant steps to prepare for disasters and support their community. By introducing the Smart-E loan program, they provide low-interest loans for renewable energy and energy-efficient home improvements. This initiative not only helps low-income families reduce their energy costs, but also builds resilience against financial shocks caused by seasonal weather changes, inflation, or utility reassessments. Offering programs like low-interest loans for renewable energy and energy-efficient home improvements, as seen with Guadalupe Credit Union's Smart-E loan program, demonstrates a commitment to building the community's resiliency and overall well-being.

Low-income families have little discretionary income and struggle with a high energy burden. Energy burden, the proportion of income spent on energy costs, is greatest among low income and minority families in the United States. Home energy costs can often spike during seasonal shifts in weather or due to inflation or utility reassessments. These increases create a financial shock that forces low-income families to choose between necessities such as food, medicine, rent, transportation or childcare and their household heating or cooling.

Guadalupe Credit Union’s Smart-E loan program makes renewable energy or energy efficient home improvement loans accessible to low-income minority homeowners. Winona Nava, former President and CEO of Guadalupe Credit Union, has been a long-time champion for low-income minority communities. Recognizing her commitment to building community resilience, Nava won the Herb Wegner award from NCUF in 2023. When two employees, Mario Vega and Diane Sandoval-Griego, participated in the non-profit Inclusiv’s free Solar Lending Professional Training program, they learned about the Smart-E product and presented it to Nava. She knew it would be an ideal offer for Guadalupe’s members.

Guadalupe Credit Union serves northern New Mexico. This region is home to a predominantly immigrant, indigenous and low-income population that is growing just as the state is experiencing record heat during their summers, water shortages and larger and more costly wildfire seasons. New Mexico’s low-income families now pay 15% of their income for energy costs, which is double the national rate.

While wealthier families are more likely to access loans for green and renewable energy home projects, Nava believes access to low-interest loans and incentives for such improvements should be more accessible. Guadalupe Credit Union already provides greater member access to banking products than commercial banks by accepting diverse types of identification, including ITINs and state IDs, but the Smart-E loan expands this access to clean energy home improvement loans to help low-income families reduce their energy costs.

What are Smart-E loans? The loans can range between $5000–$50,000 and can be used to purchase renewable home energy systems, such as solar panels, or to purchase energy-efficient heat pumps and other appliances or to make energy efficient home improvements by replacing windows or adding insulation. These loans are offered in partnership through Inclusiv, an organization that works with credit unions across the country to help low-income people achieve financial independence, and Inclusive Prosperity Capital, an organization that partners with local communities to finance green energy solutions. Inclusive Prosperity Capital has offered Smart-E loans direct to consumers in Connecticut, Michigan and Colorado with a default rate that has been close to zero for the twelve years of the program.

This partnership helped to fill a gap for credit unions. Inclusiv’s Center for Resiliency and Clean Energy started hearing from their member credit unions about the need for low-risk small-dollar energy loans. Many credit unions told Inclusiv they weren’t offering energy loans because they don’t have expertise in energy issues and don’t have the resources to help members evaluate installers or home improvement choices. Since Inclusive Prosperity Capital identifies quality contractors and energy efficient projects as part of the Smart-E product, Inclusiv decided to partner with Inclusive Prosperity Capital to offer the Smart-E loan to credit unions.

Guadalupe Credit Union introduced the Smart-E program during their free Home Energy Earth Day Celebration on Saturday, April 22, 2023 at their branch on the south side of Santa Fe where the community skews towards younger families and newer homeowners. Leaders from both Inclusiv’s Center for Resiliency and Clean Energy and Inclusive Prosperity Capital were in attendance to celebrate and to share information with the families that were enjoying delicious tacos, a children’s art station sponsored by the Santa Fe Museum of Art, and a raffle for an array of artisanal products from the local farmer’s market.

Since low-income and immigrant communities often lack financial education and many people are new to banking, Guadalupe offers free financial education and counseling. Diane Sandoval-Griego, the Chief Inclusion Officer, knows that the roll-out of Smart-E will be slow until community members understand that energy efficient improvements don’t have to be unaffordable and will reduce household costs in the long term.

Today, Ms. Sandoval-Griego is focused on including information about the Smart-E loan in the financial education courses and helping loan recipients communicate the benefits of energy efficiency by word-of-mouth to their friends and family. She believes that community already sees Guadalupe Credit Union as a trusted partner and that over time it will learn to trust that the Smart-E program will benefit not only their household’s financial health but our shared environment.

With the Smart-E program, this strategic partnership between a national non-profit, a boundary-less green bank and community credit unions leverages the strengths and capacities of each partner to create more sustainable communities.

Credit Union Takeaways

Here are some key takeaways from Guadalupe Credit Union's approach to disaster preparedness that other credit unions can adopt. By adopting these strategies, other credit unions can enhance their disaster preparedness efforts and better support their communities:

- Create low-interest loan programs to increase access to energy efficient products and services: Introducing programs like the Smart-E loan can help members finance renewable energy or energy-efficient home improvements. This not only reduces their energy costs but also builds resilience against financial shocks caused by seasonal weather changes, inflation, or utility reassessments.

- Pair free financial education with new programs to be a partner to members as they consider less familiar products and services: Providing free financial education and counseling services can help members understand the benefits of energy-efficient improvements. Including information about relevant loan programs in these courses can build trust and encourage word-of-mouth communication about the program's benefits.

- Leverage strategic partnerships to increase your knowledge and reach for new initiatives: Collaborating with organizations like Inclusiv’s Center for Resiliency and Clean Energy and Inclusive Prosperity Capital can enhance the effectiveness of your initiatives. These relationships leverage the strengths of each partner and amplify a credit union’s ability to build more sustainable and disaster-resilient communities.