Overview

Credit unions can play a pivotal role in preparing their communities for disasters. Tinker Federal Credit Union (TFCU) in Oklahoma has set a strong example with its proactive initiatives to help its community prepare for tornadoes. By introducing the first Storm Shelter loan in 2011, TFCU made shelters more affordable for homeowners through low-interest rates—ensuring that their members have access to safe shelters during emergencies. TFCU's Storm Shelter program also randomly selects a loan recipient each year and pays off their entire Storm Shelter loan. This innovative approach encourages members to take a proactive approach to disaster preparedness by investing in storm shelters while addressing slow-moving disasters by increasing property values.

“Living here in Oklahoma, you get in the habit of preparing for tornadoes,” says Cindy Vo, Senior Project Marketing Manager for Tinker Federal Credit Union. “Our stormy season starts in March and goes until May. You never know what the year will bring. One year can be mellow, the following year the storms may be really bad.”

Oklahoma, which calls itself the “Tornado Capital of the World”, experiences an average of fifty tornadoes per year many of which can exceed winds of 200 miles per hour. When a tornado touches down, it can spread a path of devastation about a half-mile wide across entire communities, destroying homes, businesses, cars and taking lives in only five to ten minutes. Each year an average of eighty people in the U.S. die in tornadoes and many are injured which can result in financial shocks to families from medical bills and lost wages in addition to property losses.

Every Oklahoman is likely to experience a tornado first-hand in their lifetime. The state’s Department of Emergency Management recommends that Oklahomans be prepared for an emergency with battery-powered radios, stored food, and generators. However, the most important thing to have during a tornado is safe shelter that is accessible on your property or in your neighborhood. A storm shelter can be the difference between life and death.

Vo, who lives in Oklahoma City, says that when she bought her first home last year, “the first thing I did was build a storm shelter for my own peace of mind.”

“Last year was also the first time I had to use it,” she added. Her parents were visiting her when a tornado warning was announced on the news. “We went immediately into the shelter to wait out the storm. A storm is so unpredictable, so it’s great to know that I have a place to go to protect not only myself but my whole family.”

Tinker Federal Credit Union (TFCU), the largest credit union in Oklahoma, understands the impact tornadoes can have on communities. On May 20, 2013, an EF-5 storm—the highest intensity tornado on the Fujita scale—touched down in Moore, Oklahoma. The storm killed 24 people, destroying many homes and two schools. The TFCU branch in Moore took a direct hit. The 14 employees and eight members at that branch, as well as a police officer and a passerby, safely rode out the storm in the vault even though the branch was destroyed. The vault was constructed with five-inch-thick concrete panels fixed to the foundation with steel rods and was the only part of the structure to survive the storm.

TFCU member Dena Clark, who took shelter in the vault during the storm, told TCFU on the one-year anniversary of the storm, “I am so grateful for the people at the Moore branch and the friendships we have made from that day. My husband and I just celebrated our first year of marriage and buying our first house—none of that would have happened without TFCU and how the people there saved my life.”

“The whole team was scared and worried about their homes,” writes TFCU CEO Dave Willis. “It was important that everyone had a safe place until they could return to their homes and families. So, at TFCU, we get it.”

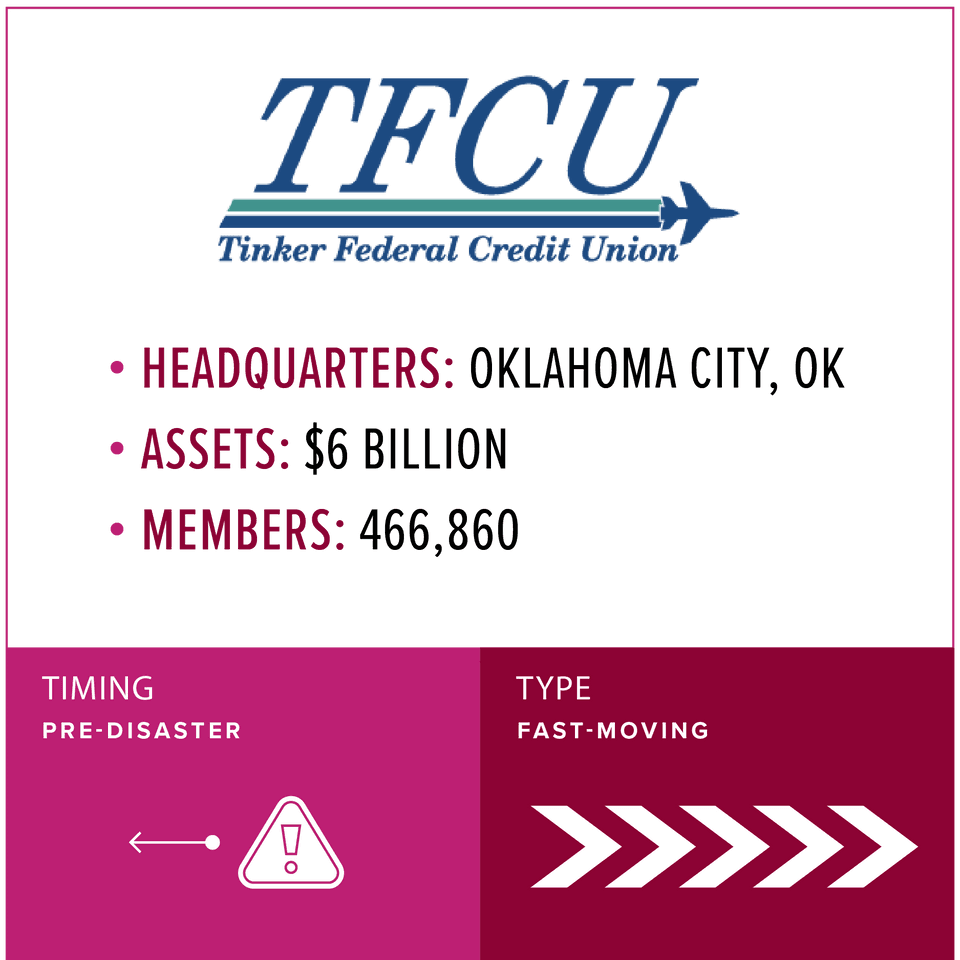

TFCU, based in Oklahoma City and with more than 30 branches throughout Oklahoma, has over 460,000 members and more than $6 billion in assets. With members and employees all faced with the same storm risks, the credit union identified a way to help its communities weather the annual tornado season. In 2011, TFCU introduced the first Storm Shelter loan, a low-interest product to make shelters more affordable to homeowners.

A storm shelter is typically a subterranean space in the backyard or under a garage or a small strong outbuilding without windows. Construction costs average $3000 but can run to $5000. Shelters are usually quickly approved by a city and can be built within weeks. Today, TFCU provides a Storm Shelter loan at 2.99% but rates can be as low as 2.75%.

People usually start thinking about getting a storm shelter once the Oklahoma storm season really gets going, but it is crucial to think about it as soon as possible so that you are prepared before the season, and for every season after. Vo likes to tell TFCU members that she works with that a storm shelter is not only important for emergencies and are low cost and low maintenance, but they add enormously to a property’s value.

“It probably sounds odd to someone not from here, but when you are shopping for a home in Oklahoma, you really do prioritize homes with storm shelters,” Vo says. “Building a storm shelter will give you more than a 100% return on the investment.”

While TFCU has been offering the Storm Shelter Loan since 2011 and is one of the only financial institutions in the country to offer such a product, many community members were not aware of its existence. Those who applied for the loan were typically TFCU members who already had a home or auto loan. So, in 2022, TFCU decided to introduce a Storm Shelter Payoff to bring more awareness to the product.

Many years ago, TFCU had started a wildly popular Great Member Give Back program in which members are randomly selected for “give backs”. A give back is one way that TCFU returns profits to its members and can include a reimbursement of a TFCU mortgage payment or a $1000 payment to a TFCU credit card or even the payoff of an entire TFCU auto loan. It seemed obvious to TFCU to add the Storm Shelter program to its Give Back program. Today, TFCU draws the name of one loan recipient each May and pays off the entire Storm Shelter loan.

In 2022, Eber and Maria Diaz de Leon won a Storm Shelter Loan Payoff of $3,794. The couple from Coweta, Oklahoma have three young children and decided to get a storm shelter after a tornado touched down near their home in early 2021. The construction company they hired had recommended Tinker Federal Credit Union because the credit union had the best loan rate. They became members of TFCU because of the Storm Shelter loan.

Maria Diaz, who works in an insurance agency, says of building the storm shelter, “It’s like an insurance plan.”

Each April, the TFCU marketing team draws a member’s name for the payoff and Vo’s team makes the call in early May.

“It’s typical that when we call the member, they think it’s a scam,” Vo says. “There is always that initial shock. This is not real!”

Eber Diaz agrees, recalling his reaction to the call from TFCU. “I didn’t believe it. I wanted to make sure it was true.”

In 2023, long-time TFCU members and retirees Roland and Linda Baker from Sparks, Oklahoma, were also shocked to find out they had won $3,694 to pay off their storm shelter loan.

“I told Roland, I’ll believe it when I get the paper that says it’s paid off,” Linda told TFCU upon winning. “We’re going to frame the paper receipt!”

“We always borrow our money from here,” Roland said of TFCU. “They treat you right!”

The Storm Shelter Loan program and the Payoff promotion have cemented Oklahomans trust in Tinker as a community partner, and that is why Vo advocates for more credit unions to think of low-cost ways to help their communities prepare for disasters.

“It’s important to have something like this—even if it’s a smaller loan—because it can have a big impact for families,” she says.

She knows that introducing new products around climate-related disasters—tornadoes, hurricanes, floods and wildfires—might be difficult for credit unions with smaller memberships or fewer deposits. Because many people think of weather-related events as unpredictable and are unsure if global warming is causing the frequency and severity of storms to increase, financial institutions are not certain of how to help their members prepare for disasters. However, we do know that with population growth and patterns of urban migration, more and more Americans are living in areas that are vulnerable to weather-related disasters. So, Vo thinks it is important to offer products what will have real value for the membership when they are most vulnerable. Furthermore, offering that product in the most accessible way will naturally build the credit union’s reputation in the local community.

It is important to offer products what will have real value for the membership when they are most vulnerable. Furthermore, offering that product in the most accessible way will naturally build the credit union’s reputation in the local community.

“Try to rally your key decision makers—your own board, CEO, internal decision makers—around the product as a community service,” she advises. “And don’t forget that there is great value in doing a payoff promotion.”

“What I do in marketing is behind-the-scenes stuff. This promotion allows me to be in front of the membership and hear their stories.” Vo says of the annual payoff event. “When we started talking to the winners, we got a good picture of how this really changes their lives. Even though it’s usually only $3–4,000 that we pay that off, for a lot of them, that’s money they can use for other financial needs. It feels really good to me. I love to help them.”

Credit Union Takeaways

Tinker Federal Credit Union has developed several strategies to help communities prepare for and respond to tornadoes, which are common in Oklahoma. These practices demonstrate TFCU's dedication to community safety and resilience, making them a trusted partner in disaster preparedness:

- Create products and services that fulfill the specific needs of your members: TFCU identified a need within their community to increase access to low-cost storm shelter funding. By looking at their specific members’ needs, TFCU has created a unique product that has a real local impact, ensuring more people have access to safe shelters during disasters.

- Increase disaster preparedness by adding incentives to products and services: Increase awareness and encourage more members to invest in disaster preparedness by adding incentives like TFCU’s Great Member Give Back program, which randomly select a loan recipient each year and pays off their entire Storm Shelter loan.

- Keep your commitment on the members: TFCU's commitment to its members is evident in their efforts to provide financial products that address real needs. By offering Storm Shelter loans and the payoff program, TFCU helps families prepare for disasters and supports their financial well-being.