Earlier this month, we launched an ambitious new offering from Filene to help credit unions better understand their members. Member Pulse is a powerful consumer segmentation model designed specifically for credit unions to tailor their offerings, operations, and marketing to the needs, attitudes, and behaviors of five different types of credit union member.

One initial reaction we’ve heard is why? Why do we need segmentation? Put most simply, dividing your membership into segments allows you to understand better their needs and behavior and send the right message to the right member. One classic example is that you wouldn’t typically want to send an equity line offer to someone who doesn’t own a home. They would feel that you didn’t understand them and their needs. Segmentation in that most basic case (homeowner vs. non-homeowner) provides some value, but of course, segmenting solely on homeownership isn’t the most effective method.

That leads us to the second reaction we’ve heard: Why do we need a new segmentation model? Why can’t we stick to the tried-and-true methods we’ve used for decades?

That brings us to the patented Vahrenkamp Model of Segmentation.

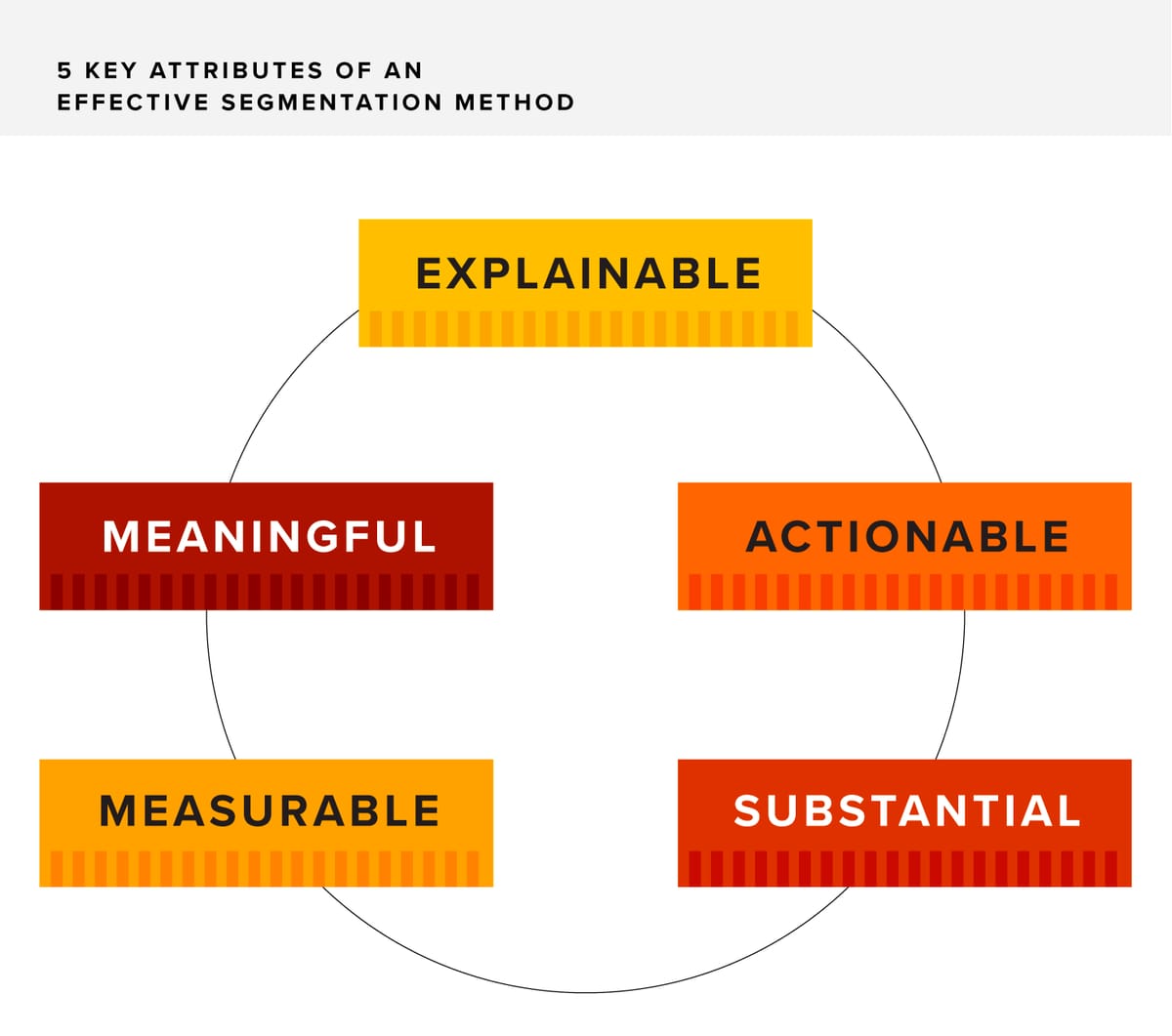

An effective segmentation method has five key attributes:

- Explainable: Segments should be easy to explain to stakeholders. If you are presenting a segmentation analysis to executives, employees, or boards of directors, the segments should have clear definitions and understandable names. Overly complicated definitions or names that seem too much like "bankerese" or are too cutesy can lead to confusion.

- Actionable: Each segment should be different and unique from the other segments. If you want to understand your membership, you want to avoid double-counting or triple-counting your members. Having unique segments ensures that when you add all the segments together, you get a total that you can believe in.

- Substantial: Each segment should be able to be identified, targeted, and tracked over time. You want to be able to find the members in each segment and then measure their behavior over time, especially as you develop marketing and product development strategies meant to impact their behavior. Some segmentation methodologies result in members changing segments frequently, like segmentations based on balance or profitability. In these circumstances, it can be hard to impact effective change, since the members are a moving target.

- Meaningful: Targeting and tracking the segments should provide additional value to the credit union. This is the most important attribute. A segmentation method might make great sense, be easy to use and explain, but if it doesn't provide a lift to marketing efficiency, response rates, ROI, or member engagement or assist in designing products and services, it's not meaningful. They need to provide value or explain significant differences in member attitudes or behavior, and if they don't, or don't anymore, then it's time to consider something new.

Let’s consider how this would work with a use case example:

A credit union wants to send a special marketing message to members who likely have deposits somewhere else, to encourage those members to bring their savings to the credit union. The marketing analyst starts by finding members who have fewer than $1000 at the credit union. Easy. Then, using traditional demographic segmentation, the credit union might limit their query to high-income and older members who, generally speaking, are more likely to have high deposits. And then they send an email with a high certificate rate and wait for the deposits to roll in.

However, those members, used to receiving certificate offer after certificate offer, are unimpressed. While demographics might say they are likely to have deposit balances, they say nothing about whether those members would trust the credit union with their funds or be moved by an offer.

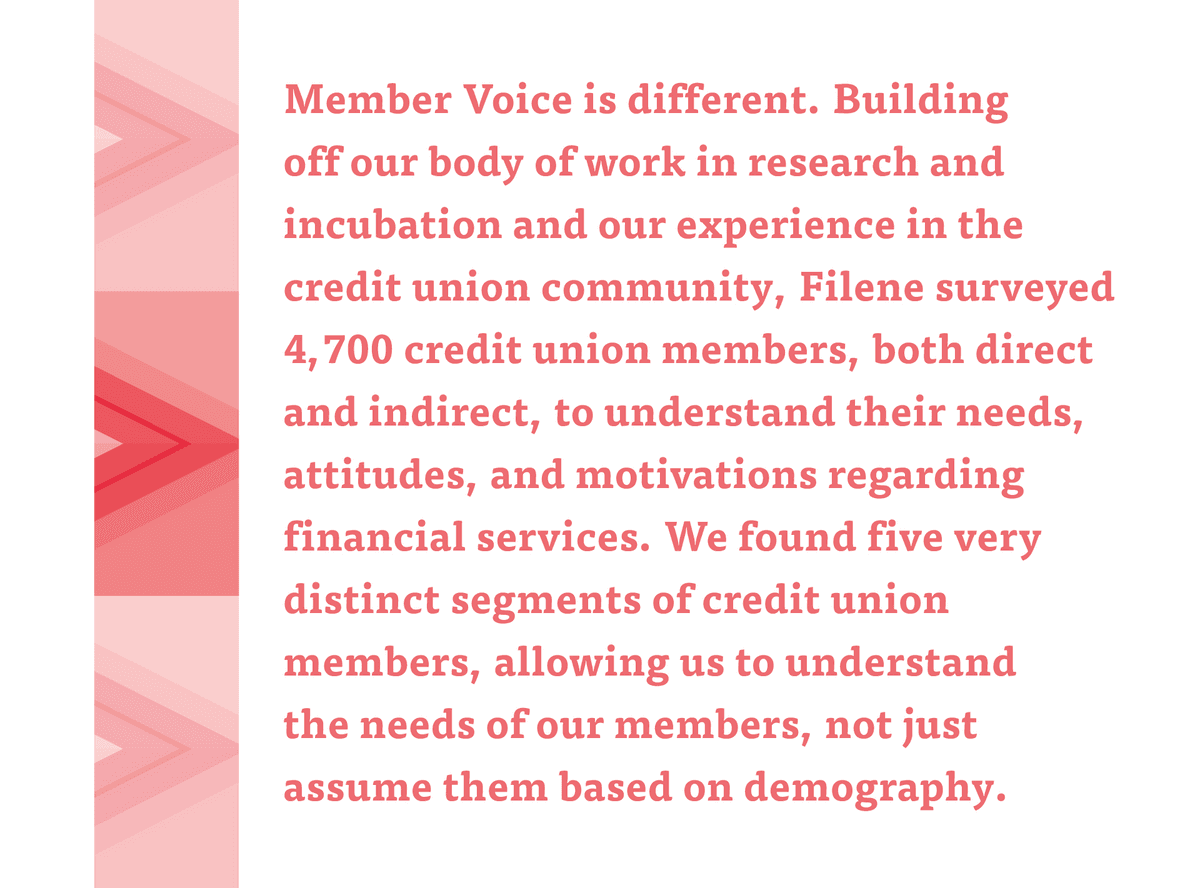

Member Pulse is different. Building off our body of work in research and incubation and our experience in the credit union community, Filene surveyed 4,700 credit union members, both direct and indirect, to understand their needs, attitudes, and motivations regarding financial services. We found five very distinct segments of credit union members, allowing us to understand the needs of our members, not just assume them based on demography.

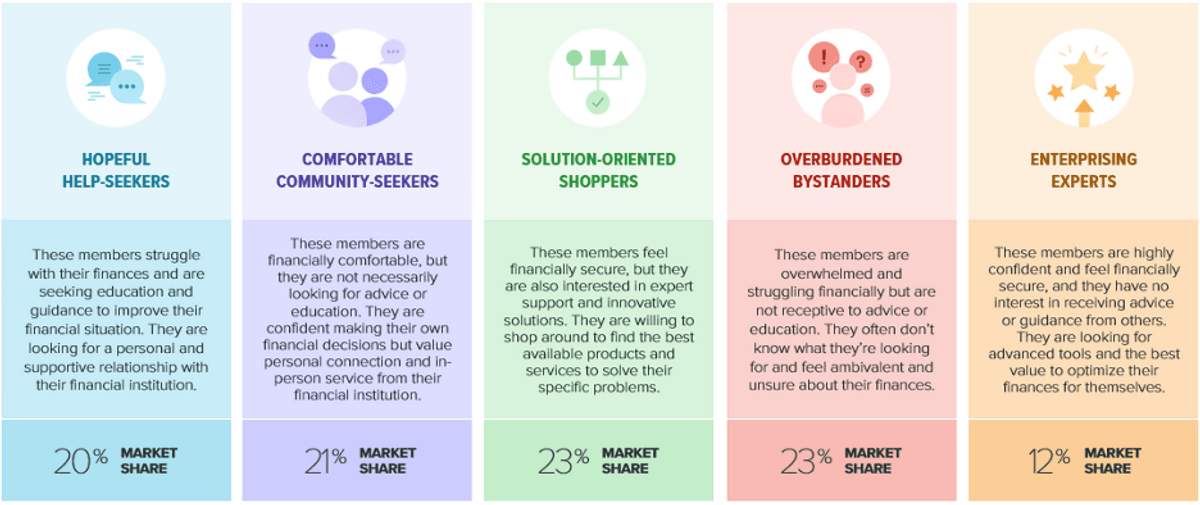

The Member Pulse Segments

Going back to our deposit example, we’ve found that two of our five segments, representing only about a third of all members, are substantially motivated by pricing and features. Concepts like relationship, trust, and expert guidance motivate the majority of members. To connect with their members, the credit union can tailor its email to each segment:

- Hopeful Help-Seekers: talk about how the credit union can support them to grow their savings and show them how to make smart savings decisions

- Comfortable Community-Seekers: reference the credit union's long history of great service and trust while mentioning current offers

- Solution-Oriented Shoppers: lay out the current rate, features, and real benefits of saving with the credit union

- Pressured Optimists: focus on how easy and non-threatening the process of saving can be, that the credit union can simplify their life

- Enterprising Experts: throw that big special rate out there and let them know they can do the whole process on their phone in seconds

Five very different messages for five very different types of credit union members. Marketing is just one use case for Member Pulse. Consider using Member Pulse segments to design deposit (or lending) products, help empower front sales representatives to have more meaningful conversations, or understand the opportunities across markets as you grow.

We believe that Member Pulse—explainable, actionable, substantial, measurable, and meaningful—represents an immense step forward for credit unions to relate to their members, and we can’t wait to share more from our research and innovation process!

— CV