One of our newest Centers of Excellence at Filene is “Design for Digital,” and already, it’s providing great information to Filene members. The fellow for the Center, Gerald Kane from the University of Georgia, posted a blog last month called “Going Digital Without Losing Distinction: Credit Unions and the Power of Personalization." In it, Dr Kane makes a key point: “Effectively using data and technology can enhance member intimacy, not erode it.”

Our Member Pulse segmentation method does exactly that. Using account and transaction data, we can identify the motivations of credit union members: the “how” and “why” a member chooses to use their credit union. By connecting with those motivations, credit unions can enhance member intimacy, deepen relationships, and find new pathways for growth.

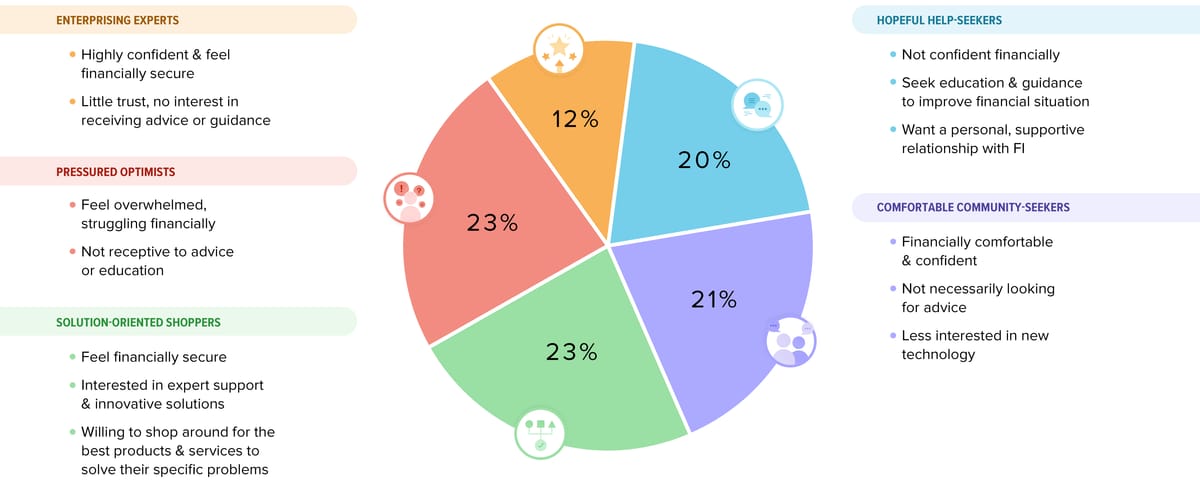

Here are the five Member Pulse Segments:

In addition, our FiLab group has created a six-part Credit Union Landscape Report. They found that most credit unions have five key strategic priorities for 2025. Let’s examine each of those priorities through a lens of understanding your members!

Membership Growth

Only 44% of credit unions grew their membership in 2024. All credit unions are looking for new members, especially new young members, and for many, this means expanding into new markets.¹

Credit unions don’t exist in a vacuum. A member choosing to use a credit union is selecting that credit union from a variety of financial institutions; why would a prospective member choose you, specifically?

Every credit union’s membership consists of a specific blend of Member Pulse segments. Some may have more Hopeful Help-Seekers, others may have more Pressured Optimists. Our hypothesis is that the prospective members most likely to join your credit union are those who most resemble your current members.

We’ve been working with a credit union to use Member Pulse to identify markets where the credit union’s brand can resonate best. We know that they have a preponderance of Solution-Oriented Shoppers; markets who share that preponderance will be better candidates for new branches, all things being equal. Using Member Pulse will help this credit union build new locations where they are most likely to succeed!

Deposit Growth

The median credit union only grew shares by 0.7%, in 2024, and more critically, 70% of all credit union deposits are held by a mere 10% of members.² Growing deposits is no longer simply a matter for liquidity; it is now essential for relevance, competitiveness and trust for the preponderance of members.

Many credit unions struggle to make their deposit products relevant, because as an industry, we have failed to connect our products with member needs. In lending, we have learned to sell not a mortgage but the opportunity to buy a home not a vehicle loan but the independence of having a new car. Member Pulse allows us to design and target deposit products to the needs and attitudes of members.

Hopeful Help-Seekers are looking for ways to save, to set a plan for the future, and to build confidence; they are not rate-sensitive. Solutions like add-on time deposits or savings accounts that reward monthly deposits make great sense, especially when positioned as “let us help you save for your future.”

Enterprising Experts, on the other hand, want to optimize their portfolio: they want the latest and greatest new products and services, the best returns, and the best technology. Solutions like a top of the line HSA, an investment sweep account, or the ability to buy crypto make sense for this group, especially when positioned as “you know what you’re doing; you deserve the best.”

Developing the right product mix for your members can give you a leg up on broadening that deposit base.

Member Experience

There is a rule of thumb in credit union marketing circles that the first 90 days of a member’s relationship are the most critical to building a strong connection. Expectations for those new members have changed. 71% of consumers now expect personalized interactions, and 76% report feeling frustrated when those expectations aren’t met.³ In addition, over half (53%) of consumers explicitly expect their financial provider to leverage their personal data to create a more tailored and relevant experience for them.⁴

While a credit union can use the same one-size-fits-all strategy to engage new members, Member Pulse can help make these initial conversations and connections much more personal and effective.

Comfortable Community-Seekers can receive messages of the credit union’s impact in the community, not-for-profit cooperative model, and strong local history, while Pressure Optimists can receive onboarding that stresses simplicity, ease of use, and automated payments and alerts.

Imagine how engaged new members could be if you spoke their language!

Operational Efficiency

In 2005, the average credit union had an operating expense to assets ratio of 3.66%. Nineteen years later, after almost doubling their assets, the average credit union OpEx ratio was 3.70%. In other words, all the scale and all the recent digital upgrades credit unions have implemented have yet to produce meaningful bottom-line efficiency gains.⁵

In addition, employees spend up to 40% of their time on administrative work that could be automated. This diverts capacity from high-value efforts, heightening the risk of burnout and human error.⁶

I’ve heard it said that you can never “cut your way to high performance”; the key to operational efficiency is not spending less but doing more with what you do spend.

Member Pulse helps do that. An add-on developed by our partners at Vertice AI creates legal-compliant marketing copy using the attributes for each Member Pulse segment. These first drafts save a significant amount of time while also increasing your ROI for a given marketing campaign by writing messaging that connects with a member’s needs and motivations.

Fraud & Risk Management

In 2024, financial institutions saw a 121% increase in consumer scam losses as a share of total fraud losses compared to 2023.⁷ Even worse, for every $1 lost to fraud, a credit union spends $4.79 in additional expenses, including fines, labor, and interest.⁸

While credit unions can solve some of these challenges with improved fraud detection, member education can play a key role in reducing fraud. A standard security pitch may not resonate with all members who need to hear it, though.

Consider looking at an education message through a Member Pulse lens: Enterprising Experts may get a message like “You’re smart enough to avoid scams, keep a look out for these that try to target you”; while Comfortable Community-Seekers may hear “Scammers have been ripping through our community; come in so we can help keep you safe.” Regardless, the message is “We know you; we know how to protect you.”

No matter what strategic issue a credit union has, using data and technology to enhance member intimacy can bring success.

Credit unions have a litany of strategic priorities: growth, member experience, risk management, and optimizing operational efficiency. But there is a hidden nuance here—as important as it is to address member experience on its own, it’s also critical to think about your members’ experience as you execute on actions to increase growth, manage risk, and optimize efficiency. Member experience needs to be part of every strategy—and understanding who your members are is the first step of that.

— CV

Endnotes

¹ NCUA data

² National Credit Union Administration. (2025, March). Quarterly credit union data summary: Fourth quarter 2024. https://ncua.gov/files/publications/analysis/quarterly-data-summary-2024-Q4.pdf, Argyle, B., Iverson, B. C., Kotter, J. D., Nadauld, T., & Palmer, C. (2025). Sticky Deposits, not Depositors. Available at SSRN 5208272

³ McKinsey & Company. (2021, November 16). The value of getting personalization right—or wrong—is multiplying. https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying

⁴ Marous, J. (2025, June 2). 5 emerging trends in personalization and CX for 2025. The Financial Brand. https://thefinancialbrand.com/news/personalization/5-emerging-trends-in-personalization-and-cx-for-2025-185743

⁵ NCUA data

⁶ Gartner, Inc. (2024). Top priorities for financial services leaders in 2025

⁷ TransUnion. (2025). H1 2025 state of omnichannel fraud report. https://www.transunion.com/content/dam/transunion/us/business/collateral/report/GFS-24-3205974-H1-2025-State-of-Omnichannel-Fraud-Report1.pdf

⁸ LexisNexis Risk Solutions. (2024). True cost of fraud study: U.S. and Canada financial services and lending. https://risk.lexisnexis.com/insights-resources/research/true-cost-of-fraud-study-financial-services-lending.