Every generation faces a series of unique financial headwinds and tailwinds, from recessions and pandemics to technological marvels and booming economies.

Generation Z (born roughly between 1996–2010) is no exception. Volatility and temptation are the words I would use to best describe major themes impacting their views on money and spending.

For credit unions, when it comes to marketing, messaging, support, and education, understanding the unique headwinds and modern vices is imperative. Fintechs and financial institutions are bombarding young people with marketing messaging, but very few are focused on the key money issues causing economic anxiety. By speaking to pressing issues that impact young people, a new generation of prospective members can discover that credit unions are the best institution to serve them.

The Economic Landscape for Gen Z

I’ve been conducting focus groups with young people for nearly twenty years (and when I started, I was one of them). Some themes have stayed constant over the decades—dating woes, first loves, identity struggles, big dreams, unexpected pivots. But over the past six or so years, as my groups have shifted to primarily Gen Z participants, one topic has become much more central: money, or more specifically, the feeling that there isn’t enough of it. I started hearing refrains like, “I’ll never be able to buy a house,” or “I can’t imagine having kids—I’ll never be able to afford it.” I wanted to understand whether this was rooted in actual economic realities or more of an emotional perception. The answer, as it often is, is both.

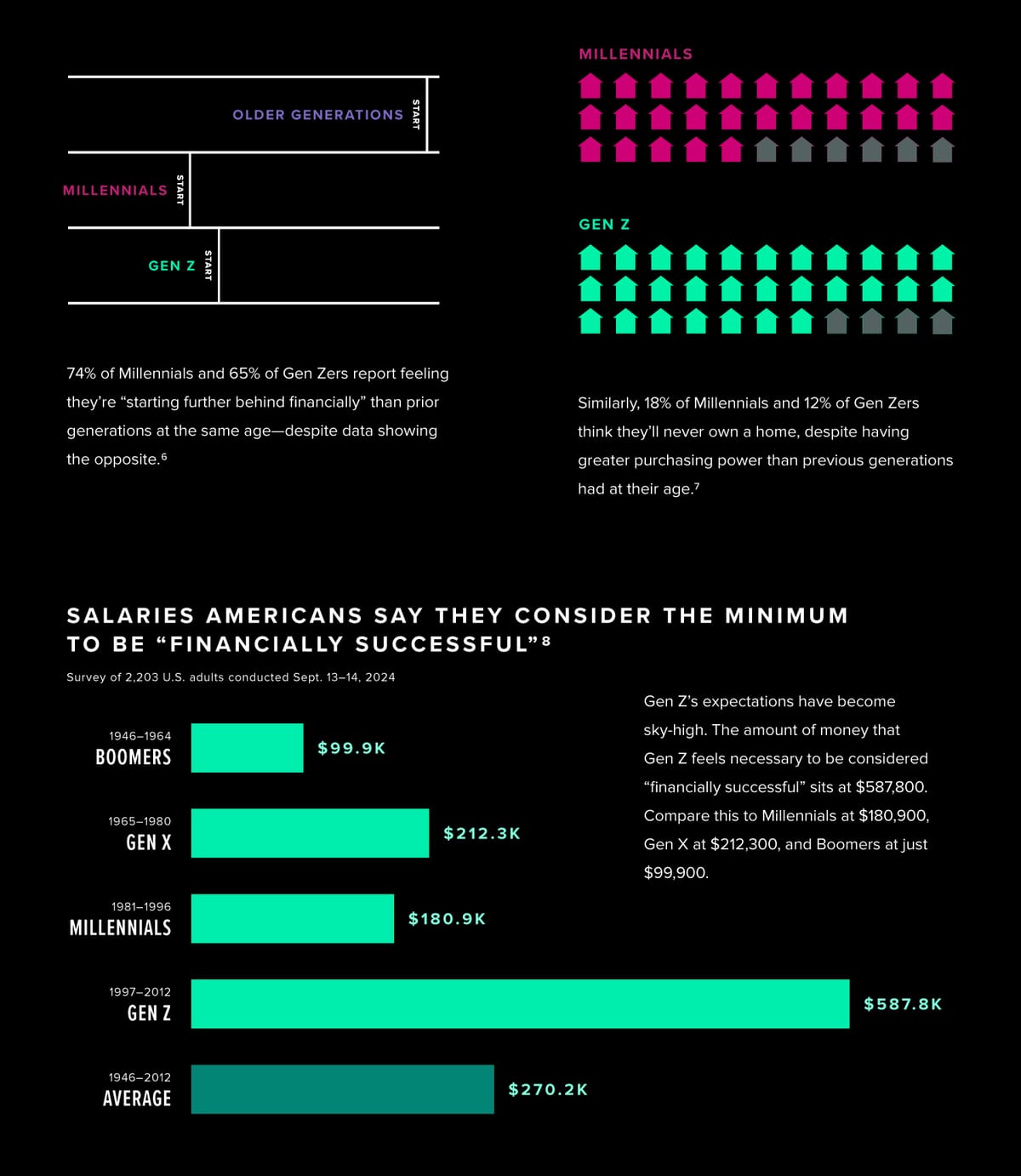

Let me provide a quick lay of the land on the financial starting line for Generation Z.

Regardless of strong wage growth and low employment, financial anxiety remains high. In other words, on paper things are going surprisingly well for many Gen Zers, but the vibes are off. The gap between objective financial progress and subjective financial stress is referred to as "phantom wealth."

The “always behind” feeling and the elevated financial expectations partially stem from how social media has come to dictate expectations about where to vacation, what kind of house to live in, and which products to buy. Algorithms curate endless images of upgraded lifestyles, making “average” look like failure. Feeling perpetually behind feeds the urge to leapfrog with get-rich-quick schemes—or to binge-spend as relief from constant restraint.

It’s no surprise now that social media-driven overconsumption and the proliferation of online gambling and sports betting are having significant impacts on Gen Z’s spending, saving, and investing. Unchecked, these vices can derail pathways to financial freedom for potential credit union members.