Executive Summary

With the rise of data-driven organizations in the financial services industry, it is essential for credit unions to accelerate value creation through the use of analytics. However, there is a lack of skilled analytical employees and challenges to finding and hiring the desired talent across all roles in the current labor market. Critically, credit unions commonly struggle with understanding the portfolio of quantitative skills needed and how to obtain these skills. Developing and executing a credit union analytics capability requires organizations to have the following skill sets—employees with:

- Deep knowledge of credit union business processes and, more specifically, how "your" credit union implements these processes.

- An understanding of the credit union's data, and skills to manage and govern the use of data.

- Quantitative skills to analyze and interrogate the data so that the story of the data can be told and appropriate actions taken.

Credit Union Implications

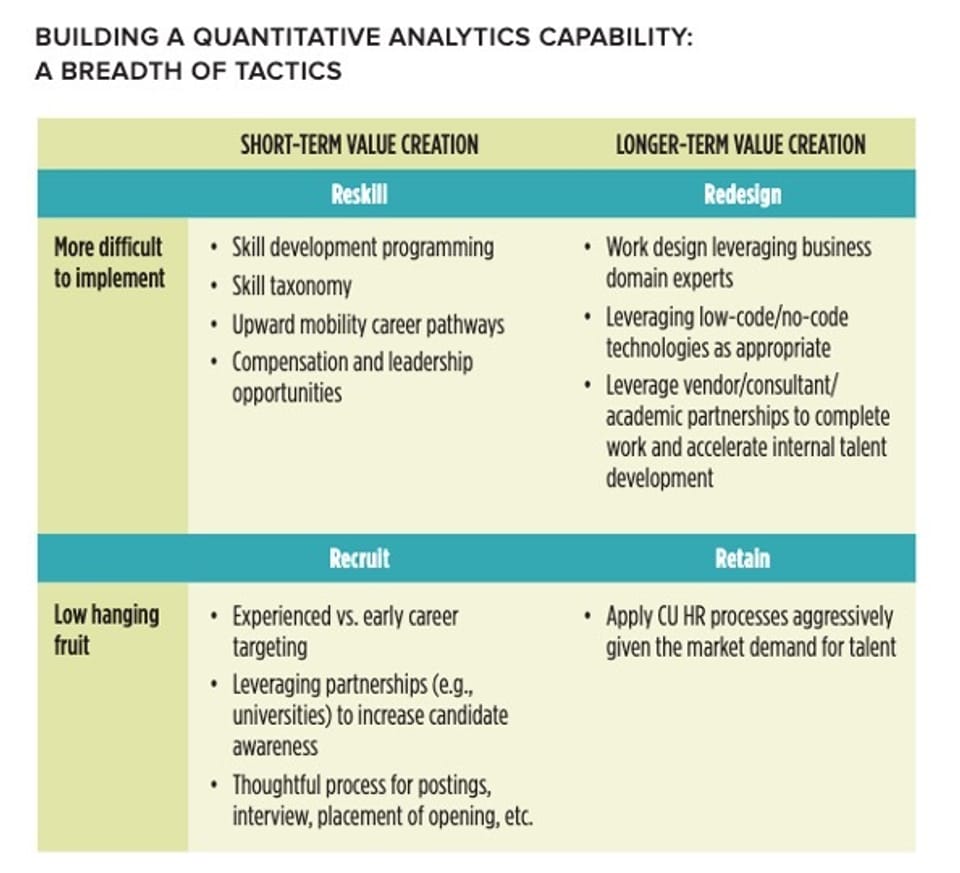

It is critical to acquire, develop, and retain analytical human capital to support a credit union’s data-driven strategies. Unfortunately, there is no silver bullet to meeting the data scientist hiring challenge, but as noted throughout this report and in the figure to the right, there are a variety of tactics that a credit union can and should implement to move its data-driven strategy forward.

Filene's Center for Data Analytics & The Future of Financial Services is generously funded by: