Consumer Financial Lives in Transition led by Dr. Lisa Servon

Credit unions have long offered financial education and coaching, but is it effective?

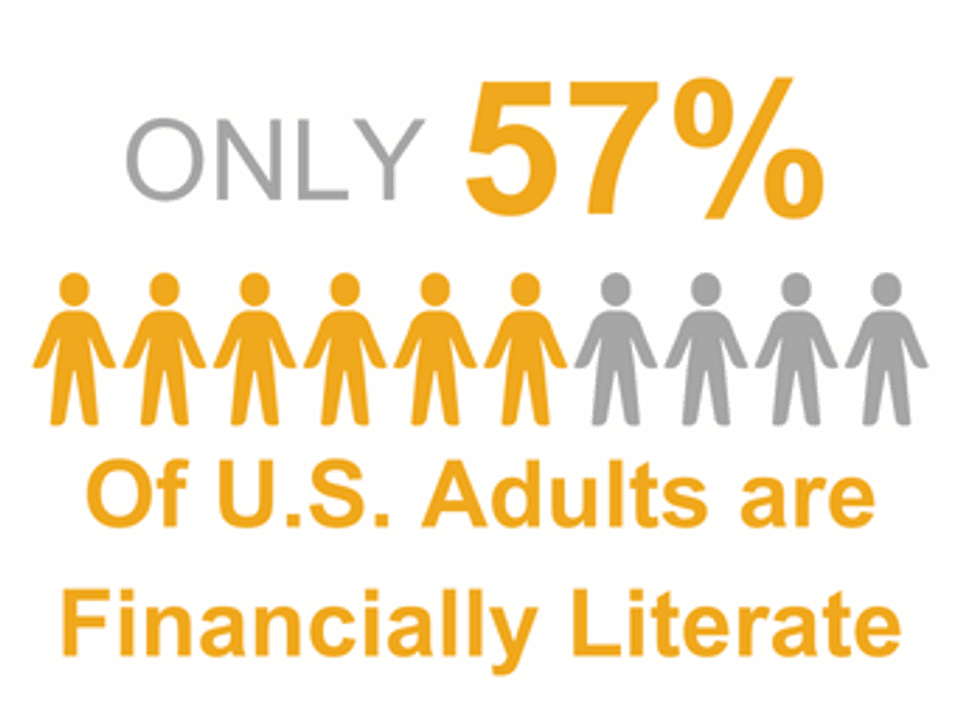

- Average American citizens have acknowledged their growing need for expanded financial expertise, yet according to a recent survey conducted by Standard & Poor’s, only 57% of U.S. adults are financially literate.

- This project will study how just-in-time and culturally appropriate financial education can help credit unions connect with their members and drive improved financial well-being outcomes.

Impact

Our research underscores the vital importance of what credit unions have always prided themselves on – truly knowing their members. This research would highlight the opportunities for credit unions to nurture their relationships with members by being able to offer the culturally appropriate types of education at the right time.

How Credit Unions Can Get Involved

- Credit unions can participate in Filene's HerMoney program to support financial well-being.

Community Social Impact led by Dr. Mai Nguyen

CDFI certified credit unions and the positive impact they have on their communities.

- Since 2018, the CDFI (community development financial institution) industry has grown to $452 billion as CDFIs provide services to revitalize underserved communities.

- CDFIs have a long track record of working closely with local communities to tackle social and economic issues from housing, transportation, healthcare, and education to food insecurity, technology access, and green space.

Impact

What CDFI certification means for credit unions is an under-explored topic, and this work builds on Filene's past research about credit union giving and its impact. A common question that credit unions ask is " how can I measure the effectiveness or the impact of my credit union's community involvement efforts?" Good news—we have a project coming out on the development of a Community Social Impact Dashboard. In partnership with Callahan & Associates, we will utilize high-impact metrics using 5300 Call Report data as well as self-populated fields to provide credit unions with individualized social impact scores. With this new tool, credit unions will be better able to understand how they can start measuring impact and where they are in their social impact journey.

Next Steps

Interested in learning more about our new Community Social Impact Dashboard? We will be presenting it during Spark! 2024.

Diversity, Equity, & Inclusion led by Dr. Quinetta Roberson

Driving financial inclusion through inclusive products and services.

In 2023, Filene published results from our 2nd DEI Practices and Policies survey which highlighted the importance of strategic and measurement practices for credit unions interested in activating their DEI journey. 2024's survey (year 3) will focus on DEI from the credit union member perspective.

- It is likely that there will be another practices and policies survey that will include insights for credit unions to realize business value from their DEI efforts.

- Other outputs include research on ERGs and leveraging DEI in supply chain partners and suppliers.

Impact

- Credit unions have made significant investments in creating more diverse, equitable, and inclusive workforces. Research from the DEI CoE has shown that the most effective DEI strategies in terms of impact on business performance and organizational culture are holistic, connecting the operations, talent, and member-facing parts of the credit union.

Innovation & Incubation led by Dr. Jeffrey Robinson

Credit Union of the Future led by Dr. Lamont Black

- Research Projects: Launching SOON!

- Questions that the Center for the Credit Union of the Future will address:

- What trends will enable credit unions to best use their limited resources to adapt strategically to an increasingly fast-paced, competitive, and technology-driven landscape?

- Which trends in innovation and disruption (digital banking & BAAS, AI, crypto & digital assets, metaverse) should be prioritized by credit unions?

- Why is this important?

- This exciting new research center will help credit unions prepare for what’s next. It will take an ecosystems approach to identify and develop new business models that will ensure ongoing growth and sustainability to survive and thrive in the future.

Leadership, Strategy & Governance led by Dr. Amy Hillman

This new research center will deliver fresh approaches to leadership and governance.

- Research projects: Launching SOON!

- Questions the Center for Leadership, Strategy & Governance will address:

- How can leaders advance talent in today's changing workplace?

- How can credit unions establish unique positions within a challenge field?

- How can boards and governance become a strategic asset?

- Why is this important?

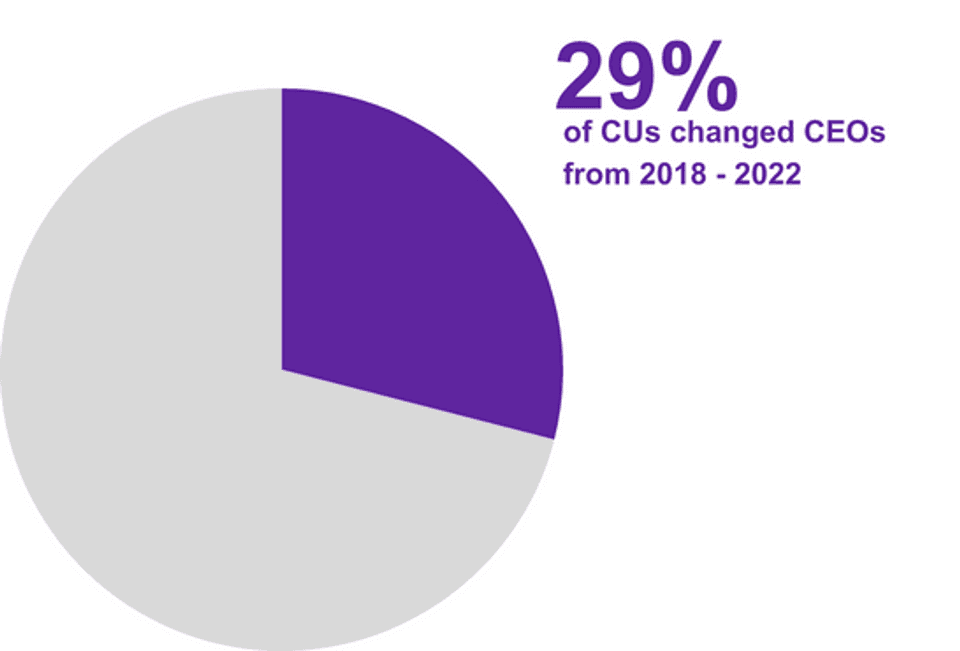

- 40% of CEOs are at retirement age

- 80% of credit unions have no succession plan

- 29% of CUs—almost 1/3 of the industry changed CEOs between 2018 and 2022

- 40% of CEOs are at retirement age